Fidelity Retirement: Your Ultimate Guide To Securing A Bright Financial Future

Retirement planning might feel like a distant dream, but it's actually one of the most important steps you can take for your financial future. Fidelity Retirement is here to help you navigate the complexities of saving and investing for your golden years. Whether you're just starting out or looking to refine your existing strategy, this guide has got your back. Let's dive in and make sure you're set up for success!

Let’s face it, folks—retirement isn’t just a random milestone; it’s the culmination of years of hard work, dedication, and smart decisions. And when it comes to making those decisions, Fidelity Retirement stands out as a trusted name in the game. They’ve been helping millions of people like you build secure financial futures, and we’re about to break down why they’re worth considering.

Now, I know what you’re thinking: “Do I really need to start thinking about retirement now?” The short answer? Absolutely yes. The earlier you start planning, the more time your money has to grow. And with Fidelity Retirement by your side, you’ll have access to tools, resources, and expert advice that can turn your financial dreams into reality. So buckle up, because we’re about to deep-dive into everything you need to know!

Read also:Sabrina Banks Leaks The Untold Story You Need To Know

Why Fidelity Retirement Matters

When it comes to retirement planning, not all financial institutions are created equal. Fidelity Retirement shines because of its commitment to providing personalized solutions, cutting-edge technology, and a wealth of knowledge. But why should you trust them over the competition? Let’s break it down:

- They’ve been around for over 70 years, which means they’ve seen it all—from market booms to busts.

- Fidelity offers a wide range of investment options, including IRAs, 401(k)s, and annuities, so you can tailor your plan to fit your unique needs.

- Their customer service team is top-notch, with real people ready to answer your questions and guide you through the process.

But don’t just take my word for it. According to a recent study by Morningstar, Fidelity consistently ranks among the best in terms of customer satisfaction and investment performance. So yeah, they’re legit.

Understanding the Basics of Fidelity Retirement

What Exactly Is Fidelity Retirement?

At its core, Fidelity Retirement is more than just a savings account—it’s a comprehensive approach to building long-term financial security. Think of it as your personal financial coach, helping you set goals, create a strategy, and stay on track. Here’s how it works:

- You open an account tailored to your retirement needs, whether that’s a Traditional IRA, Roth IRA, or employer-sponsored 401(k).

- You contribute money regularly, often through automatic transfers, so you never miss a payment.

- Your contributions are invested in a diversified portfolio designed to grow over time.

And the best part? You get access to Fidelity’s world-class research and tools, so you’re always in the know about market trends and investment opportunities.

How Fidelity Retirement Can Help You Save

Maximizing Your Contributions

One of the coolest things about Fidelity Retirement is how they help you make the most of your contributions. Whether you’re saving for a rainy day or planning for retirement, maximizing your contributions is key. Here are a few tips:

- Take advantage of employer matching if you have a 401(k). It’s basically free money!

- Consider opening both a Traditional and Roth IRA to diversify your tax strategy.

- Automate your contributions so you don’t even have to think about it.

According to Fidelity’s own data, people who automate their contributions tend to save 30% more over time. So yeah, setting it and forgetting it really does work.

Read also:Amber Daniels The Rising Star Shining Brighter Every Day

Fidelity Retirement Investment Options

Choosing the Right Portfolio

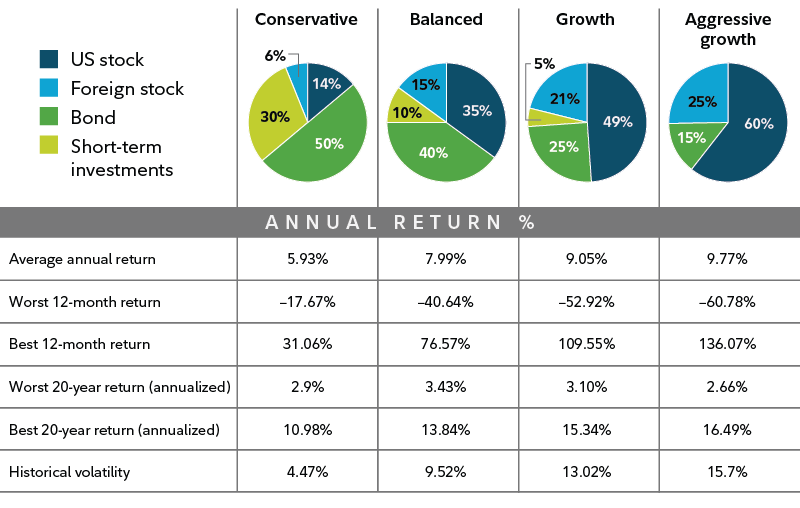

When it comes to investing, Fidelity Retirement gives you a ton of options. From mutual funds to exchange-traded funds (ETFs), there’s something for everyone. Here’s a quick rundown of the most popular choices:

- Index Funds: These are low-cost funds that track a specific market index, like the S&P 500. They’re great for hands-off investors.

- Target-Date Funds: These funds automatically adjust your portfolio mix as you get closer to retirement, so you don’t have to worry about rebalancing.

- Bonds: For those who want a bit more stability, bonds can be a great addition to your portfolio.

Of course, the right portfolio depends on your risk tolerance, time horizon, and financial goals. Fidelity’s experts can help you figure out what works best for you.

Common Misconceptions About Fidelity Retirement

There are a lot of myths floating around about retirement planning in general, and Fidelity Retirement is no exception. Let’s bust a few of the biggest ones:

- Myth: Fidelity only caters to wealthy clients. Fact: Fidelity offers plans for people at every income level, from entry-level workers to high-net-worth individuals.

- Myth: You need a ton of money to get started. Fact: Many Fidelity accounts have no minimum balance requirements, so you can start small and build over time.

- Myth: Once you set up your account, you’re done. Fact: Retirement planning is an ongoing process, and Fidelity provides the tools you need to stay on top of it.

By separating fact from fiction, you can make more informed decisions about your financial future.

Fidelity Retirement vs. Competitors

So how does Fidelity stack up against other big players in the retirement space? Let’s compare:

- Vanguard: Known for its low-cost index funds, Vanguard is a strong competitor. However, Fidelity offers a wider range of investment options and more personalized service.

- Charles Schwab: Schwab is another big name, but their customer service ratings tend to lag behind Fidelity’s.

- TIAA: While TIAA focuses on retirement plans for educators and non-profits, Fidelity serves a broader audience.

Ultimately, the best choice depends on your individual needs, but Fidelity’s combination of affordability, flexibility, and customer support makes them a top contender.

How to Get Started with Fidelity Retirement

Step-by-Step Guide

Ready to jump in? Here’s how you can get started with Fidelity Retirement:

- Visit Fidelity’s website and click on “Open an Account.”

- Choose the type of account that fits your needs—IRA, 401(k), etc.

- Fill out the application, which will ask for some basic info like your Social Security number and employment details.

- Set up your initial deposit and contribution schedule.

It’s that simple! And if you run into any issues, Fidelity’s customer service team is just a phone call away.

Tips for Maximizing Your Fidelity Retirement Plan

Now that you’re all set up, here are a few tips to help you get the most out of your Fidelity Retirement plan:

- Stay Consistent: Regular contributions are key to building wealth over time.

- Review Your Portfolio Regularly: Markets change, and so should your investment strategy. Fidelity makes it easy to rebalance your portfolio as needed.

- Take Advantage of Educational Resources: Fidelity offers webinars, articles, and videos to help you stay informed about the latest trends.

Remember, retirement planning isn’t a one-and-done deal. It’s an ongoing process that requires attention and care.

Real-Life Success Stories

Don’t just take our word for it—let’s hear from some real people who’ve benefited from Fidelity Retirement:

Sarah M., Age 45: “I started my Fidelity IRA when I was 30, and I’m so glad I did. Thanks to consistent contributions and smart investments, I’m on track to retire comfortably in my early 60s.”

John D., Age 52: “Fidelity’s customer service has been a lifesaver. When I had questions about my 401(k), they walked me through everything step by step.”

Hearing from real people can make all the difference when you’re considering a financial decision. These stories show that Fidelity Retirement can work for anyone, no matter where you are in your journey.

Future Trends in Retirement Planning

As the world of finance continues to evolve, so do the tools and strategies available for retirement planning. Here are a few trends to watch:

- Robo-Advisors: These automated platforms are becoming increasingly popular for their convenience and low fees.

- Socially Responsible Investing: More and more people are choosing investments that align with their values, and Fidelity offers plenty of options in this space.

- Digital Currency: While still controversial, some experts believe cryptocurrency could play a role in retirement portfolios in the future.

Staying informed about these trends can help you make smarter decisions about your financial future.

Conclusion

So there you have it—a comprehensive guide to Fidelity Retirement and why it’s worth considering for your financial future. From personalized investment options to world-class customer service, Fidelity has everything you need to build a secure and comfortable retirement.

Now it’s your turn to take action. Whether you’re just starting out or looking to refine your existing plan, Fidelity Retirement can help you get there. So what are you waiting for? Head over to their website today and take the first step toward your dream retirement.

And don’t forget to share this article with your friends and family. After all, the more people who know about Fidelity Retirement, the better off we all are!

Table of Contents

- Why Fidelity Retirement Matters

- Understanding the Basics of Fidelity Retirement

- How Fidelity Retirement Can Help You Save

- Fidelity Retirement Investment Options

- Common Misconceptions About Fidelity Retirement

- Fidelity Retirement vs. Competitors

- How to Get Started with Fidelity Retirement

- Tips for Maximizing Your Fidelity Retirement Plan

- Real-Life Success Stories

- Future Trends in Retirement Planning

Article Recommendations