Chase Mortgage: Your Ultimate Guide To Financing Your Dream Home

So, you're thinking about diving into the world of Chase Mortgage, huh? Whether you're a first-time homebuyer or looking to refinance your current property, this guide's got everything you need to know. Chase Mortgage is more than just a loan; it's your ticket to turning that dream house into a reality. Let's break it down step by step, so you can make the smartest financial decision possible.

Buying a home is one of the biggest investments you'll ever make, and finding the right mortgage is key. Chase Mortgage has been around for a while, and they've helped millions of people secure their dream homes. But before you jump in, it's important to understand what Chase Mortgage offers and how it fits into your financial picture.

In this article, we'll cover everything from the basics of Chase Mortgage to advanced tips for getting the best rates. We'll also dive into the pros and cons, common questions, and even throw in some insider tips. By the end of this, you'll feel like a mortgage pro ready to take on the housing market.

Read also:Tulsi Gabbard Parents The Unsung Pillars Behind A Political Phenomenon

Understanding Chase Mortgage Basics

What Exactly is Chase Mortgage?

Alright, let's start with the basics. Chase Mortgage is a mortgage lending service provided by JPMorgan Chase, one of the largest banks in the U.S. They offer a variety of mortgage options designed to fit different needs, whether you're buying a starter home or upgrading to something bigger. Think of Chase Mortgage as your partner in the home-buying journey.

Chase Mortgage isn't just about giving you a loan. They focus on providing personalized service and flexible options. From fixed-rate to adjustable-rate mortgages, they've got something for everyone. And don't worry if you're not sure what all those terms mean—we'll get to that later.

Types of Chase Mortgage Loans

Here's where things get interesting. Chase offers several types of mortgage loans, each tailored to different situations. Let's break it down:

- Fixed-Rate Mortgages: These are the most common. You lock in an interest rate that stays the same throughout the life of the loan. Great for budgeting because your payments won't change.

- Adjustable-Rate Mortgages (ARMs): These start with a lower interest rate that can change after a set period. Good if you plan to sell or refinance before the rate adjusts.

- FHA Loans: Backed by the Federal Housing Administration, these are ideal for first-time buyers with lower credit scores.

- VA Loans: Specifically for veterans and active military personnel, these often come with no down payment requirement.

- Jumbo Loans: For those high-end properties that exceed conventional loan limits.

Each option has its own perks, so it's all about finding the one that aligns with your financial goals.

Why Choose Chase Mortgage?

Trust and Reputation

Chase has been around since 1799, making it one of the oldest and most reputable banks in the country. That kind of history means they know a thing or two about lending. They've helped millions of people buy homes, and they continue to innovate in the mortgage space.

But it's not just about the name. Chase Mortgage is known for its customer service, which can make all the difference when you're navigating the complex world of home financing. Plus, they offer online tools and resources to make the process smoother.

Read also:Aisha Sofey Leaks Unveiling The Truth Behind The Controversy

Competitive Rates and Fees

One of the biggest draws of Chase Mortgage is their competitive rates. They frequently offer promotions and discounts, especially for existing Chase customers. And while rates can vary based on factors like credit score and loan type, Chase strives to keep things fair and transparent.

Another thing to consider is fees. Chase Mortgage typically has lower origination fees compared to some other lenders, which can save you money in the long run. Just be sure to read the fine print and compare offers before signing on the dotted line.

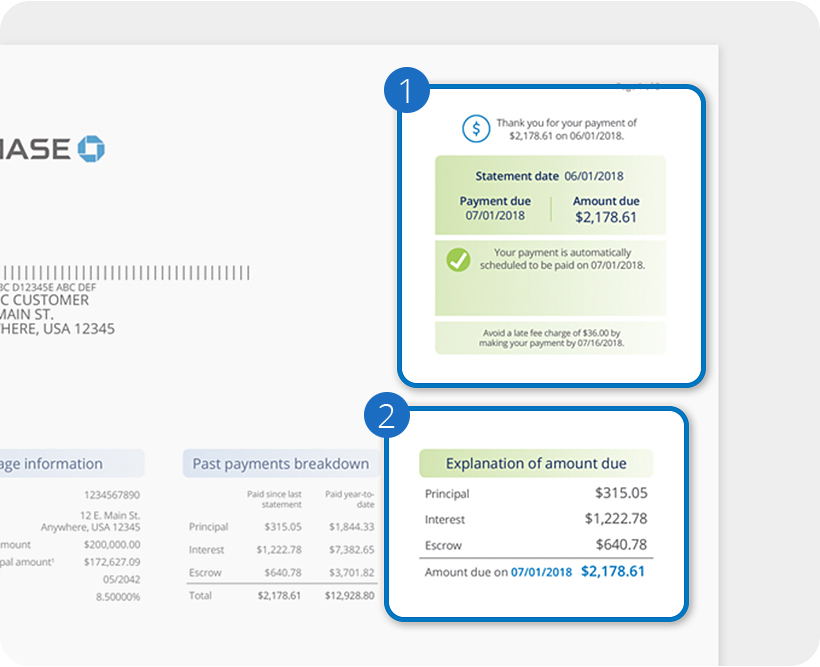

How to Apply for a Chase Mortgage

Step-by-Step Guide

Applying for a Chase Mortgage doesn't have to be a headache. Here's a quick rundown of the process:

- Pre-Approval: Start by getting pre-approved. This gives you an idea of how much you can borrow and shows sellers you're serious.

- Gather Documents: You'll need proof of income, tax returns, bank statements, and other financial info. The more organized you are, the smoother the process will be.

- Submit Your Application: You can do this online or in person at a Chase branch. Make sure to fill out all forms accurately.

- Underwriting: This is where Chase reviews your application and verifies your info. It can take a few weeks, so be patient.

- Closing: Once everything checks out, it's time to sign the final paperwork and close on your loan.

See? Not so bad, right? The key is to stay organized and communicate with your loan officer throughout the process.

Common Questions About Chase Mortgage

Can I Get a Mortgage with Bad Credit?

Absolutely. Chase offers FHA loans, which are designed for borrowers with lower credit scores. While having good credit increases your chances of getting better terms, Chase understands that everyone's financial situation is different. They'll work with you to find a solution that fits.

What Are the Current Interest Rates?

Interest rates fluctuate based on market conditions, but Chase consistently offers competitive rates. As of 2023, fixed-rate mortgages are hovering around 6-7%, while ARMs might start lower. Keep in mind that rates can vary depending on factors like your credit score, loan amount, and property type.

Do I Need a Down Payment?

Not necessarily. Some Chase Mortgage options, like VA loans, require no down payment. For conventional loans, a 20% down payment is ideal to avoid private mortgage insurance (PMI), but you can put down as little as 3%. It all depends on the loan program you choose.

Pros and Cons of Chase Mortgage

Advantages

- Strong reputation and customer service

- Wide range of loan options

- Competitive rates and fees

- Convenient online tools and resources

- Flexible terms for different financial situations

Disadvantages

- May require higher credit scores for the best rates

- Some fees can add up, especially for jumbo loans

- Underwriting process can take longer than expected

Like any lender, Chase Mortgage isn't perfect. But for many people, the benefits outweigh the drawbacks. It's all about weighing your options and choosing what works best for you.

Insider Tips for Getting the Best Chase Mortgage Deal

Boost Your Credit Score

Your credit score plays a huge role in determining your mortgage rate. Pay down debt, make payments on time, and avoid opening new credit accounts before applying. Every little bit helps.

Shop Around

Don't just settle for the first offer you get. Compare Chase Mortgage rates with other lenders to ensure you're getting the best deal. You might be surprised by what you find.

Work with a Professional

Consider hiring a mortgage broker or financial advisor to guide you through the process. They can help you navigate the complexities and negotiate better terms.

Data and Statistics on Chase Mortgage

According to recent reports, Chase Mortgage is one of the top lenders in the U.S., with billions of dollars in loans issued annually. In 2022 alone, they helped over 500,000 borrowers purchase homes. That's a lot of happy homeowners!

Studies also show that Chase consistently ranks high in customer satisfaction surveys, with many borrowers praising their ease of use and transparency. These stats are a testament to their commitment to quality service.

Conclusion: Time to Take Action

So there you have it, everything you need to know about Chase Mortgage. From understanding the basics to navigating the application process, you're now equipped to make an informed decision. Remember, buying a home is a big step, and choosing the right mortgage is crucial.

Don't hesitate to reach out to Chase Mortgage for more info or to start the application process. And if you have any questions or comments, feel free to drop them below. We'd love to hear from you! Also, be sure to check out our other articles for more tips on all things finance. Happy house hunting!

Table of Contents

- Understanding Chase Mortgage Basics

- Types of Chase Mortgage Loans

- Why Choose Chase Mortgage?

- Competitive Rates and Fees

- How to Apply for a Chase Mortgage

- Common Questions About Chase Mortgage

- Pros and Cons of Chase Mortgage

- Insider Tips for Getting the Best Chase Mortgage Deal

- Data and Statistics on Chase Mortgage

- Conclusion: Time to Take Action

Article Recommendations