Fintechzoom.com Crypto Halving: A Deep Dive Into The Phenomenon That Shapes The Crypto Market

So, you've probably heard the buzz around crypto halving, right? If you're scratching your head wondering what it is or why it's such a big deal, you're not alone. In the world of fintechzoom.com, crypto halving is one of those events that sends ripples through the entire digital currency ecosystem. Imagine a clock ticking down to an event that could potentially skyrocket the value of your favorite cryptocurrency or send it crashing down. That's what crypto halving is all about. Stick around because we're about to break it down for you in a way that even your grandma could understand.

Think of crypto halving as a digital gold rush, but instead of panning for gold, miners are solving complex math problems to earn cryptocurrencies like Bitcoin. But here's the twist – every four years or so, the reward they get for their hard work gets cut in half. Crazy, right? This mechanism is baked into the code of many cryptocurrencies and is designed to control the supply and, in theory, increase the value over time. Let's dive deeper into why this matters to you and how fintechzoom.com plays a role in keeping you informed about these pivotal moments in the crypto world.

Before we get into the nitty-gritty, let's set the stage. The crypto market is like a rollercoaster – wild, unpredictable, and sometimes downright terrifying. But it's also where fortunes are made and lost. Understanding crypto halving can give you a leg up in navigating this chaotic landscape. So, whether you're a seasoned investor or just dipping your toes into the crypto pool, this article is your go-to guide for everything you need to know about fintechzoom.com crypto halving. Let's get started!

Read also:Sabrina Banks Leaks The Untold Story You Need To Know

What Exactly is Crypto Halving?

Crypto halving is like a digital treasure hunt where the prize gets smaller every time. It's a process built into the code of many cryptocurrencies, most famously Bitcoin, where the reward for mining new blocks is halved approximately every four years. This event is pre-programmed and occurs after a set number of blocks are mined. For Bitcoin, this happens roughly every 210,000 blocks. The idea behind it is to create scarcity, which in turn can drive up the value of the cryptocurrency.

Imagine you're running a lemonade stand, and every time you sell a cup, you get paid. But then one day, the rules change, and you only get half the money for each cup sold. That's essentially what happens during a crypto halving event. Miners, who are the backbone of the cryptocurrency network, suddenly have to work just as hard but for half the reward. This can lead to increased competition, higher costs, and ultimately, a potential rise in the value of the cryptocurrency as supply decreases.

Why Does Crypto Halving Matter?

Here's the deal: crypto halving matters because it has the potential to significantly impact the price of cryptocurrencies. When the supply of a digital currency is reduced, basic economics tells us that if demand remains constant or increases, the price is likely to go up. This is why many investors and analysts closely watch these events. They're seen as opportunities to potentially profit from the expected price increase.

But it's not just about the price. Crypto halving also affects miners, who are crucial to the functioning of the blockchain network. With their rewards cut in half, some smaller miners may find it no longer profitable to continue mining, which could lead to a consolidation in the industry. This can have broader implications for the decentralization and security of the network.

Impact on Miners

Miners are the unsung heroes of the crypto world. They spend significant amounts of money on powerful computers and electricity to solve complex mathematical problems that validate transactions on the blockchain. When a crypto halving event occurs, their earnings from newly minted coins are halved. This can be a tough pill to swallow, especially for smaller operations that might not have the resources to weather the storm.

Some miners may choose to shut down their operations if the costs outweigh the benefits. Others might look for ways to increase efficiency or switch to mining other cryptocurrencies. The landscape can change dramatically after a halving event, with larger mining pools potentially gaining more control over the network. This shift can have implications for the overall health and decentralization of the cryptocurrency ecosystem.

Read also:Judith Ann Hawkins The Remarkable Journey Of A Trailblazer

How Does Fintechzoom.com Fit Into This?

Fintechzoom.com is your go-to source for all things crypto. It's like having a personal finance guru at your fingertips, but with a focus on the digital currency world. The platform provides up-to-date information, analysis, and insights into the crypto market, including key events like crypto halving. Whether you're looking to understand the technical aspects of halving or trying to figure out how it might affect your investment portfolio, fintechzoom.com has got you covered.

What sets fintechzoom.com apart is its commitment to delivering accurate and timely information. The team behind the platform understands that the crypto market moves fast, and staying informed is crucial for success. With features like real-time price updates, detailed charts, and expert analysis, fintechzoom.com helps investors make informed decisions. So, whether you're a newbie or a seasoned pro, fintechzoom.com is an invaluable resource in your crypto journey.

Understanding the Mechanics of Crypto Halving

Let's break down how crypto halving actually works. It's all about the blockchain, which is essentially a digital ledger that records transactions across many computers. Miners are responsible for adding new blocks to this ledger by solving complex mathematical problems. For their efforts, they are rewarded with newly minted coins. However, the number of coins they receive is halved at regular intervals, typically every four years for Bitcoin.

This halving process is designed to control the supply of the cryptocurrency. By reducing the number of new coins entering circulation, the hope is that the value of the existing coins will increase over time. It's a bit like supply and demand in traditional markets, but with a digital twist. The key difference is that the supply is predetermined and cannot be altered by external factors, making it a unique economic experiment.

Bitcoin's Halving History

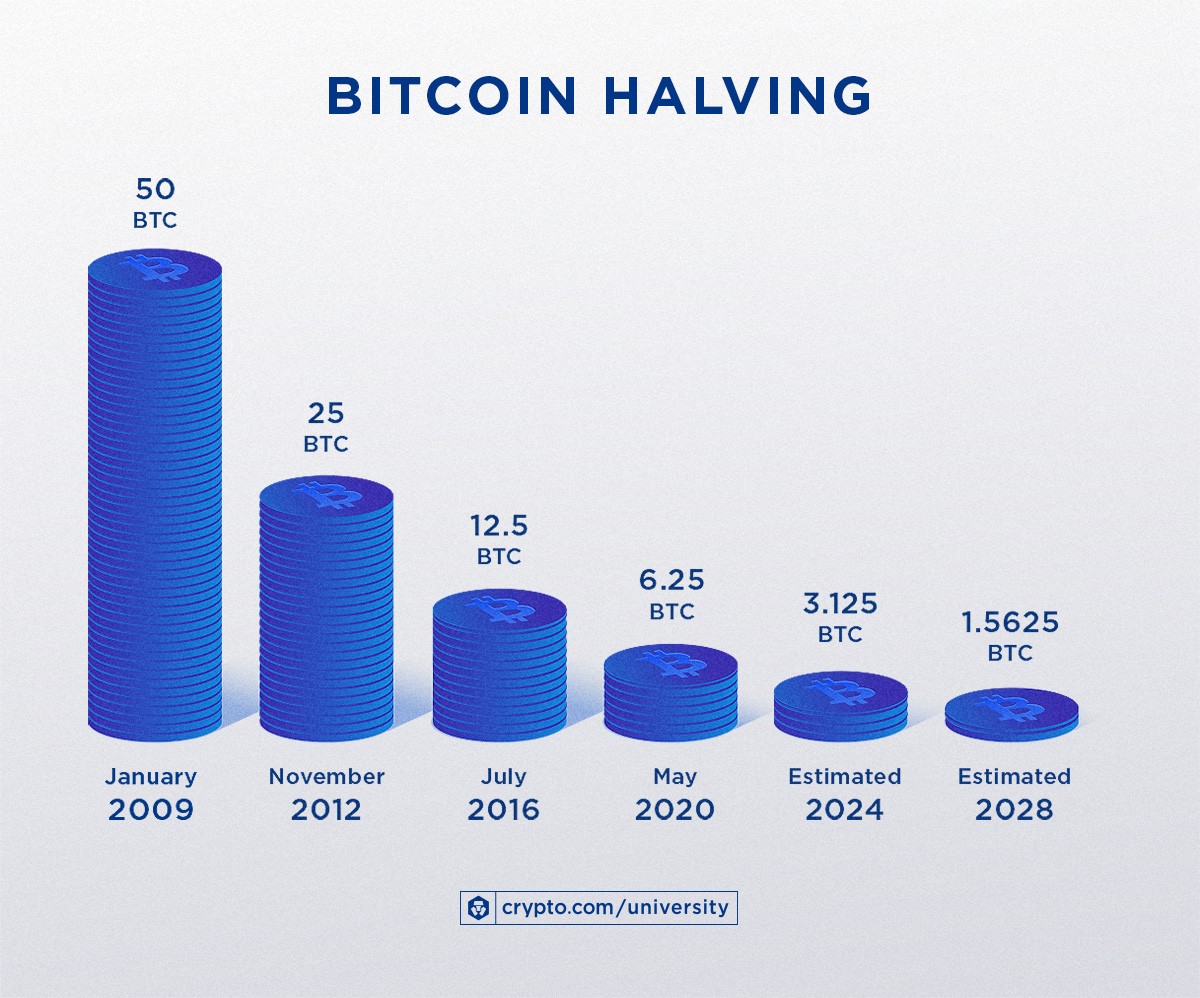

Bitcoin, being the first and most well-known cryptocurrency, has a rich history of halving events. The first halving occurred in 2012, followed by another in 2016, and the most recent one in 2020. Each time, the market reacted differently, with some periods seeing significant price increases and others experiencing more muted responses. Analysts and investors closely watch these events to try and predict future price movements.

Looking back at past halvings can provide valuable insights into what might happen in the future. While history doesn't always repeat itself, it can offer clues about market behavior and investor sentiment. For example, after the 2016 halving, Bitcoin prices saw a steady increase over the following year, culminating in the famous 2017 bull run. Understanding these patterns can help investors make more informed decisions.

Long-Term Effects of Crypto Halving

The long-term effects of crypto halving can be profound. As the supply of new coins decreases, the scarcity can drive up their value. This is especially true for cryptocurrencies like Bitcoin, which have a fixed maximum supply. Once all the coins have been mined, the only way to acquire new ones will be through transactions, making existing coins potentially more valuable.

However, the long-term effects are not just limited to price. They also impact the sustainability of the network. As mining rewards diminish, miners may need to rely more on transaction fees to make a profit. This could lead to higher fees for users, which might deter adoption. On the flip side, it could also encourage the development of more efficient mining technologies, leading to a more sustainable network.

Investor Sentiment and Market Behavior

Investor sentiment plays a crucial role in how the market reacts to crypto halving events. Some investors see these events as opportunities to buy low and sell high, while others may be more cautious, waiting to see how the market responds. The anticipation leading up to a halving can create volatility, with prices swinging wildly in the days and weeks before the event.

Market behavior can also be influenced by external factors such as regulatory changes, macroeconomic conditions, and technological advancements. While crypto halving is a predictable event, the broader market environment can add layers of complexity to how it plays out. Investors who can navigate these waters successfully may find themselves reaping significant rewards.

Key Players in the Crypto Halving Game

There are several key players involved in the crypto halving game. First and foremost are the miners, who are on the front lines of the blockchain network. Their role is crucial, and their decisions can have a significant impact on the market. Then there are the investors, who are constantly analyzing the market and looking for opportunities to profit from price movements.

Exchanges also play a vital role, providing the infrastructure for buying and selling cryptocurrencies. They act as intermediaries between buyers and sellers and can influence market dynamics through their trading volumes and fees. Lastly, there are the developers who are responsible for maintaining and improving the blockchain network. Their work ensures the network remains secure and efficient, even as the challenges posed by crypto halving increase.

Miners vs. Investors: Who Benefits More?

The relationship between miners and investors is complex. Miners benefit from the stability and growth of the network, as it ensures their operations remain profitable. Investors, on the other hand, are more focused on price movements and potential gains from their investments. While both groups have their own interests, they are interconnected and rely on each other for the ecosystem to thrive.

In some ways, miners and investors can be seen as being on opposite sides of the same coin. Miners need high prices to cover their costs and make a profit, while investors hope for price increases to realize gains. However, both groups benefit from a healthy and growing market, making cooperation and understanding essential for long-term success.

Preparing for the Next Crypto Halving

As we look ahead to the next crypto halving event, it's important to be prepared. Whether you're a miner, investor, or just a curious observer, understanding the implications of this event can help you make better decisions. Start by educating yourself on the mechanics of crypto halving and how it has impacted the market in the past. This knowledge can provide a foundation for predicting future outcomes.

For miners, it's crucial to assess your operations and ensure they remain profitable even with reduced rewards. This might mean investing in more efficient equipment or exploring alternative revenue streams. Investors should consider their risk tolerance and investment goals, adjusting their strategies accordingly. Staying informed through platforms like fintechzoom.com can give you an edge in navigating the challenges and opportunities presented by crypto halving.

Tips for Investors

Here are a few tips for investors preparing for the next crypto halving:

- Stay Informed: Keep up with the latest news and analysis to understand market dynamics.

- Assess Risk: Evaluate your risk tolerance and adjust your portfolio accordingly.

- Diversify: Don't put all your eggs in one basket. Consider diversifying your investments across different cryptocurrencies.

- Long-Term Thinking: Focus on the long-term potential of cryptocurrencies rather than short-term price fluctuations.

Conclusion: The Future of Crypto Halving

In conclusion, crypto halving is a fascinating phenomenon that has the potential to shape the future of the cryptocurrency market. From controlling supply to influencing price movements, its impact is far-reaching. Platforms like fintechzoom.com play a crucial role in keeping investors informed and helping them navigate the complexities of this ever-evolving landscape.

As we look to the future, it's clear that crypto halving will continue to be a pivotal event in the crypto world. By understanding its mechanics and implications, investors and miners alike can position themselves for success. So, whether you're a seasoned pro or just starting out, remember that knowledge is power. Stay informed, stay prepared, and most importantly, stay involved in the exciting world of cryptocurrency.

And don't forget to share your thoughts and experiences in the comments below. We'd love to hear from you and see how you're preparing for the next big crypto halving event. Until next time, keep exploring, keep learning, and keep growing your crypto portfolio!

Table of Contents

- What Exactly is Crypto Halving?

- Why Does Crypto Halving Matter?

- Impact on Miners

- How Does Fintechzoom.com Fit Into This?

- Understanding the Mechanics of Crypto Halving

- Bitcoin's Halving History

- Long-Term Effects of Crypto Halving

- Investor Sentiment and Market Behavior

- Key Players in the Crypto Halving Game

- Miners vs. Investors

Article Recommendations